by Donya Curry | Jan 12, 2021 | Bookkeeping, Business, Individuals, Non Profits

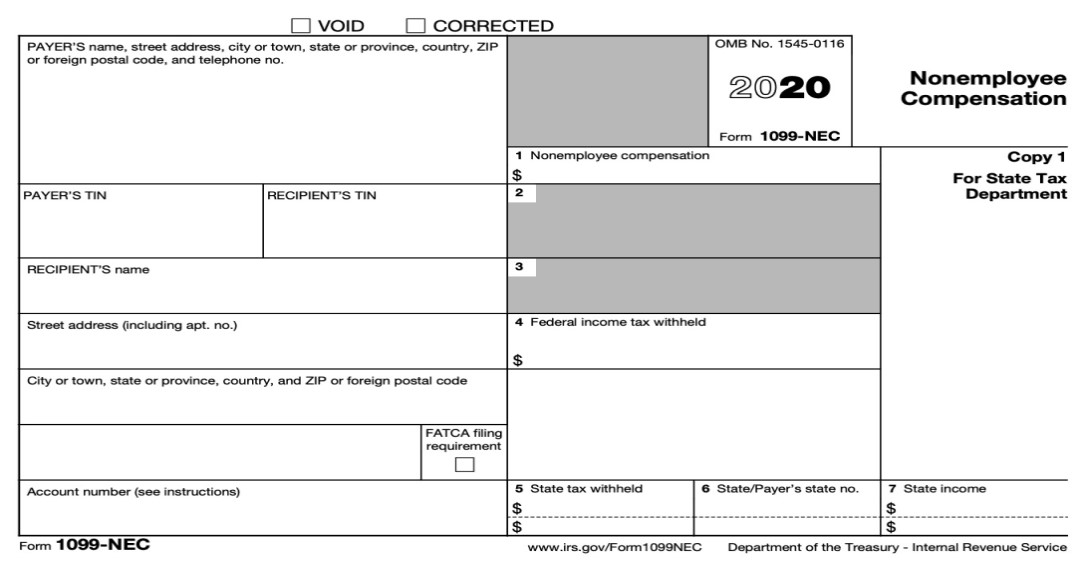

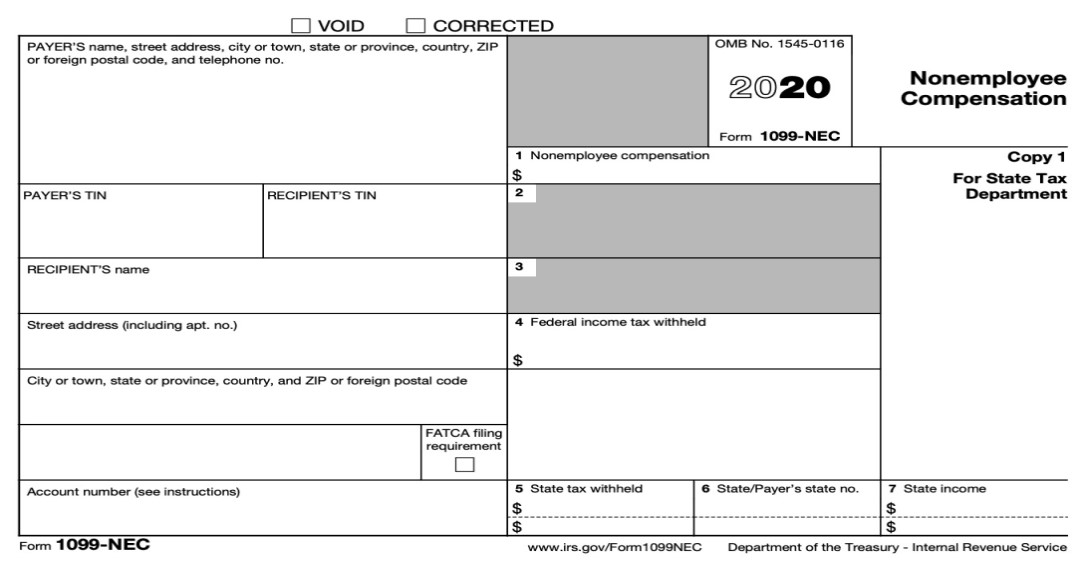

The IRS has introduced a new Form the 1099-NEC. The NEC is short for non employee compensation. This is the new form for reporting independent contractor income. The 1099-Misc will not be used to report income for individuals who’re self-employed in 2020.

What is a 1099-NEC?

The 1099-NEC is a new form created to report non-employee compensation.In previous years all independent contractors would receive a 1099-MISC form with the amount paid to you being reported in the box 7. The requirements to file a 1099-NEC are still the same as a 1099-Misc.

A 1099-NEC needs to be filed if your business paid any contractor more than $600 in a single tax year. You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment. Payments to a corporation including a limited liability company (LLC) that elected to be treated as a C or S corporation will not be required to file 1099-NEC. The exemption from reporting payments made to corporations does not apply to payments for legal services. Therefore, you must report attorneys’ fees (in box 1 of Form 1099-NEC). The entity type should be reported to you on a W-9 form.

Responsibilities for filing 1099-NEC?

It’s your company’s responsibility to file the Form 1099-NEC with the IRS and send a copy to the independent contractor by January 31. The due date is similar to the W-2’s. There are two copies that need to be filled out. Copy A is sent to the IRS while Copy B needs to be sent to the contractor. You can either e-file or send through mail.

If you missed the January 31st deadline, you will end up paying a penalty depending on how late the filing is. These penalties are:

$50 if you file within 30 days

$100 if you file more than 30 days late, but before August 1

$260 if you file on or after August 1

If you are unable to file on time, you can request an extension by submitting Form 8809 to the IRS. However, you will still need to supply the 1099-NEC forms to any contractors by January 31.If you need assistance completing your 1099 NEC. Please reach out to International Accounting & Tax Consultants (IATC Inc) at www.iatcpro.com.

by Donya Curry | Jan 11, 2021 | Bookkeeping, Business, Individuals, Non Profits

The President signed the “Consolidated Appropriations Act, 2021 into law. This law provided $284B dollars to be used for the second round of the Paycheck Protection Program. The application deadline for businesses wanting to receive a PPP2 loan is March 31, 2021. Due to the high demand expected, businesses should apply as early as possible. It is very likely the funds will be exhausted before the actual March deadline.

If your company received the first round of funding you are not automatically excluded from the second round of funding.

The new PPP2 loan requirements are a little different from the first round:

Your company must have less than 300 employees.

Must have been in operation before February 15, 2020.

Cannot be a publicly traded company.

Can’t be a business primarily engaged in political advocacy or lobbying.

Your company can not have significant ownership by Residents of China.

You must now be able to show at least a 25% reduction in gross revenue in any quarter of 2020 compared to the same quarter in 2019. If your business was new and didn’t exist the entire year of 2019. Use the quarters you were in business before February 2020.

Your business must have used the previous PPP loan or have a plan in place to use all of their original PPP loan for approved expenses.

PPP2 Forgiveness

The maximum amount of each loan is maxed at $2 million. Each entity can only have one PPP2 loan. The PPP2 loan forgiveness rules are similar to the PP1 rules. Payroll costs should account for at least 60% of the PPP2 loan amount spent and any remaining should be spent on other approved costs, all within the covered forgiveness period. The forgiveness period starts when you receive your PPP2 money in your bank account. Your company will either have an 8-week or a 24-week covered period of forgiveness. The approved Payroll costs includes an employee salary and benefits like vision and dental benefits. The “other” approved expenses would be the rent, mortgage interest, and utilities. Payments for software, cloud computing, HR systems, and accounting needs.

The PPP2 program included other additional expenses that are allowed to be covered. Any repair costs associated with looting or vandalism during 2020 disturbances when the cost of repairs were not covered by any insurance. Any payments made for essential goods for periods before the PPP2 loan was received. Payments for perishable items can also be made either before or after the PPP2 loan is received. Any PPE equipment or facility modification expenditures spent by your business to comply with COVID-19 federal health and safety guidelines. This would include items like face masks, drive-through windows, thermometers, and even HVAC improvements from March 1, 2020 throughout the year.

IATC Inc encourages businesses that qualify to apply as soon as possible for the PPP2 loan. If you need detailed information please feel free to contact us at www.iatcpro.com

by Donya Curry | Feb 18, 2019 | Business, Individuals, Non Profits

Every year millions of tax returns are audited by the IRS. The average taxpayer main concern behind paying taxes is somehow causing the IRS to audit their tax returns. It’s true that certain things can automatically trigger an audit. An audit doesn’t actually mean your return is wrong. There are items on a return that present higher opportunities for committing fraud or mistakes.

The burden of proof for taking credits and deductions falls on your shoulders. You might have to prove that you are taking a position on your return in line with current tax code.

The audits are done primarily by mail today. There is a small chance of having an auditor show up in person. No matter how your audit is done you need to respond as soon as possible to ensure they don’t give you a default position. Letter normally state you have a certain amount of days from receiving the letter to respond if you disagree. If you don’t respond they automatically assume you agree with their findings in the letter. If you respond there are one of three things that happens.

The IRS auditors decides the information provided is correct and your return stays the same.

The IRS auditor proposes a change to your tax return, and you can agree to it and/or pay the appropriate taxes, interest or a penalty.

The IRS proposes a change you don’t agree. You have a chance to appeal and enter into an agreement with the IRS.

In the cases of serious tax fraud even though it’s an extremely rare outcome. The IRS can pursue forfeiture of property, jail time, and restitution.

Audit Flags

1. Reporting the wrong taxable income

The IRS actually receives your W-2,1099, and K-1’s before the taxpayers. This goes for both full-time employees and self-employed contractors.

You should check to see if your W-2 or 1099 you receive from any company matches your own records. If you think it is incorrect, immediately inform the company, and request that they file a corrected W-2 or 1099 with the IRS. If a company fails to update their information you would have to file a complaint with the IRS to go through this process of updating those records.

2. Charity donations

If you’re giving away large amounts of money to a charity when your income is low. Be prepared for some scrutiny from your tax pro and the IRS. If you are audited and can’t substantiate your donations. You and the tax pro will have fines and penalties to pay. Any large donation should be appraised, and you should file the Form 8283 for any donation over $500. Make sure you keep all of your charity receipts and follow the IRS’s tips for charitable donations.

3. Business Vehicles

Cars/ SUVs are still the main transportation for alot of business owners. Having a vehicles under your business doesn’t exclude you keeping track of personal miles. Running personal errands to pick up friends and go shopping should not be included. You should always keep a record of your mileage using qualified record keeping guidelines.

4. Home office

This deduction is on a lot of peoples deduction list. Who wouldn’t want to be able to take electricity, internet, and other expenses you use at home and get a benefit. There is a specific definition of what qualifies as a home office, so claiming it could easily trigger an audit. Ensure the room is where you do the majority of your work, and that is not used for any other purpose, especially personal use. This type of deduction can trigger an in-person audit where the IRS want to actually see the room you are claiming for a business deduction.

5. Tax Errors

Simple tax mistakes like small mathematical mistakes are the top reason for alot of audits. The IRS will normally fix these and send you a correction. This can also result in you actually receiving a larger refund as well.

6. Round numbers

On indication of making up income and expenses is have a series of even or round numbers. This is a common practice for people who don’t keep records and try to prepare a return from memory. Audits don’t always happen immediately. They normally come a few years later. You should have documentation to support your deductions and credits. When preparing you return use the actual numbers that match your receipts and other records.

7. Business Losses

The main requirement for being considered to have a business by the IRS is actually doing something to earn a profit. If your business just constantly loses money year after year it will cause some red flags. If you report a loss three out of the last five years. The IRS might consider your business a hobby or fraudulent depending on your specific circumstances. If you have a business ensure your run it like one with receipts and backup.

by Donya Curry | Aug 5, 2016 | Business, Individuals, Non Profits

If you watch the news you will probably feel like there are major unexpected disasters happening every week. Unfortunately, you would still be underestimating the number of serious disasters in this country. FEMA actually tracks this data, and so far in 2016 there have been at least 69 declared disasters this year.

If you are not going to consult with a professional please review the IRS Pub 547 as it covers disasters, casualties, and thefts in-depth. A federally declared disaster is a disaster that occurred in an area declared by the President to be eligible for federal assistance under the Robert T. Stafford Disaster Relief and Emergency Assistance Act. It includes a major disaster or emergency declaration under the Act. It is true that you may deduct casualty and theft losses relating to your home, household items, and vehicles on your federal income tax return. There are always important distinctions and rules to follow. One issue that clients struggle with is not being able to deduct casualty and theft losses covered by insurance. You have to actually own the property to deduct the loss. You can be the person paying for the property, but if you are not the property owner the IRS will disallow all deductions.

What’s the difference between these losses? A casualty loss comes from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption. A casualty does not include normal wear and tear or progressive deterioration. This definition is a determining factor for clients on if you can qualify for casualty losses.

A theft is the taking and removal of money or property with the intent to deprive the owner of it. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent. You might be thinking now you can deduct some stolen items like a cellphone, laptop, or jewelry. I wouldn’t get my hopes up high just yet. The amount of your theft loss is normally your adjusted basis of the property, because the fair market value of your property after the theft is considered to be zero.

Time to Deduct

Casualty losses are deductible in the year the casualty occurred. Casualty losses from a federally declared disaster that occurred in an area warranting public or individual assistance have the option to treat the casualty loss as having occurred in the previous year immediately preceding the tax year in which the disaster happened, or you can deduct the loss on your return for the preceding tax year.

Theft losses are normally deductible in the year you discover your property was stolen unless you have a chance of recovery through a claim for reimbursement. No deduction is available until the taxable year in which you can determine with reasonable certainty whether or not you will receive a reimbursement.

Casualty Property Type

Personal-use property or property that is not completely destroyed. Casualty losses are the smaller of:

- The adjusted basis of your property, or

- The decrease in fair market value of your property as a result of the casualty

Business or income-producing property that are completely destroyed losses is the adjusted basis.

Insurance or Other Reimbursements

You must reduce the loss first, whether it is a casualty or a theft loss by the salvage value and by any insurance or other reimbursements you receive or expect to receive. The adjusted basis of your property is the cost including any improvements or depreciation.

How to Claim Your Loss

Individuals have to claim their casualty and theft losses as an itemized deduction on Schedule A. You should have subtracted any salvage value, and any insurance or other reimbursement of Personal use property already. You must now subtract $100 from each casualty or theft event that occurred during the year and add them all up. 10% of your adjusted gross income is subtracted from the total to calculate your allowable casualty and theft losses for the year. Casualty and theft losses should be reported on Form 4684.

If your loss deduction is more than your income, you may have a net operating loss (NOL). The NOL is for individuals as well as business to have an NOL from a casualty the treatment is identical. Any unused portion of a casualty loss deduction can be carried back for three years, and then carried forward for 20 years until it’s used up. In a tax year you don’t have any income you can take advantage of the deduction in the future.

by Donya Curry | Jun 17, 2016 | Business, Individuals, Non Profits

It is summer already and half of the year has already passed by. Life changes like getting married or a new job can be exciting events. This is the perfect time to see your accountant for a quick tax checkup. I normally recommend clients send in their most recent paystub. I use the stubs to check if the amount of taxes being withheld is accurate. I use this time to remind clients of the recommended strategies for tax minimization given to them previously.

The summer is provides a little more free time than during the busy season. If the strategies suggested are no longer viable we can formulate a plan tailored to your liking. A checkup is a great way to avoid any unexpected surprises at the tax desk. It still gives you time to prepare for changes you might have not been aware of. If you’re a do it yourself small business problems with your books are easier to find with less transactions. The details of events are easier to be remembered now rather than a year later.

I know it can be stressful when the tax bill is larger than originally planned. Having that knowledge know can empower you to make necessary changes for your business. You can enjoy your vacation knowing your accounting is in order. If you need bookkeeping services or an individual tax review you should Contact Us today at International Accountants and Tax Consultants.

by Donya Curry | Apr 11, 2016 | Non Profits

If you are a nonprofit some donor will eventually give you an in-kind donation instead of typical cash. In-kind donations can be tangible and intangible assets. You could be receiving tangible donated items like shirts, posters, supplies or any other items. Intangible donated items can be patents, copyrights or even professional services like legal or accounting. In-kind gifts are recorded when a donor provides the item unconditionally and without receiving anything in return. The donor should not hold a partial interest in the items donated to your organization. The IRS rules states that the value of time and services cannot be deducted by the donor.

Valuing Gifts

The first issues most nonprofits encounter is how to value the in-kind gift for donors. Nonprofits should not be actually valuing any gifts for donors. How are you going to acknowledge the donation if you have no idea what it costs? You are supposed to use the fair market value of such gifts. Use the donor’s website or local shop prices to get an idea of how much items should cost. By acknowledging the amount, it would cost you is not the same as valuing the gift. Any donated asset that does not have a value and no alternative uses should not be recognized in the nonprofit financial statements. If the products being given to your nonprofit is expired or worthless. You don’t have to recognize some items given to your organization in financial statements, but you can still provide them with an acknowledgment letter. The donor is still contributing to your nonprofit, and you still want to say thank you to organizations or individuals helping. This is a good way to make donors feel appreciated, while fostering a continued relationship.

Written Acknowledgement

A donor cannot claim a tax deduction for any single contribution of $250 or more unless the donor obtains a written acknowledgment of the contribution from the recipient organization. An organization that does not acknowledge a contribution will not incur any penalties, and aren’t really required to provide any. Without a written acknowledgment the donors cannot claim the tax deduction. Most businesses will not donate to an organization without receiving an acknowledgment. A written statement should contain certain elements. This can work for cash or non-cash contributions alike.

- the name of organization and tax Id number.

- the amount of cash contribution if any

- a detailed description without the value of the non-cash contribution

- a statement that no goods or services were provided by the organization in return for the contribution, if that was the case

- a description and good faith estimate of the value of goods or services, if any, that an organization provided in return for the contribution.

- a statement that goods or services, if any, that an organization provided in return for the contribution consisted entirely of intangible benefits.

You should you write your acknowledgement letter so it’s clear what you received from the donor. We are going to use an example of If your nonprofit organization POIU was given catering as an in-kind donation by a catering company? The catering company charged $3,500 a discounted price to do the event. Even though the catering company would normally charge customers $8,000 including staff time. How would you recognize this in-kind donation? I wrote a quick statement that you can use.

“Thank you for your generous gift of a buffet style catering for our fundraiser event in which we had 100 potential donors attend on 09-12-15. Your generous contribution will help the POIU foundation further our important work. You would be glad to know that we were able to raise $16,260 through pledges and donations that night.

Under current IRS regulations, you will not be able to declare the value of your donation from our acknowledgment. We can say that your generosity is greatly appreciated. If we had to purchase this buffet style catering on our own it would have cost us approximately $8,000. We saved $4,500 for what you gave as an In-Kind contribution. The money saved is able to go directly to support our homeless clothing initiative.”

Financial Statements

Donated services are normally recognized in the financial statements if those services are able to create or enhance a nonfinancial asset. Alternatively, if those donated services require specialized skills that are provided by an entity who possess the skills, and your entity would need to purchased them if they were not recognized. A good example would be if an accountant at IATC provides accounting services for your non-profit at no charge. The nonprofit organization would need to recognize the value of the accounting services as a contribution and related expense, because those services would need to be purchased if not otherwise provided.

Donated services that create or enhance a nonfinancial asset do not need to be specialized to be recognized, but those that neither create nor enhance a nonfinancial asset must be specialized to be recognized. In other words, you should not recognize the value of these services provided as they are not specialized skills and would not need to be purchased in the normal course of business. In-kind contributions of property but not of services should be reported on

Line 1 of Parts II and III of Schedule A;

Form 990, Part VIII line 1g;

Schedule B, Part II;

or Schedule M, column (c) if applicable

Form 990 filers generally may use any reasonable method to determine or estimate the value of these non-cash contributions. Schedule B gives you special instructions for valuing marketable securities. Schedule M requires that you report of the method used to determine the revenue attributable to the different categories of non-cash contributions. In-kind donations of services are not reported on Form 990, but the value of those services will be shown as reconciling items on the 990.

Financial Statement Disclosure

Disclosure are there to give additional insight into events. The contributed services received should disclose the events or activities for which the donated services were used. This area should give more details into about nature and extent of the contributed services, and the amount recognized as revenue during the period. This is the best place to disclose the amount of donated services received, but not recognized as revenue.

Tax Deductible Value

The value of In-Kind gifts for which the nonprofit should thank the donors for contributing is not the same as the value that the IRS allows to be deducted for tax purposes. Donors will feel they have given a lot more than what they can deduct as an in-kind donation. IRS already states donors of In-Kind gifts cannot take a deduction for the time that they donated as a part of an In-Kind gift. Donors are able to deduct only their actual out-of-pocket expenses. The donor itself is responsible for having the receipts before taking such a tax-deduction for their charitable gifts. Let us take our catering example If you are given catering as an in-kind donation by a catering company. The catering company spent $1,500 on the food and supplies to make the event possible. Even though the catering company would normally charge customers $ 8,000 including staff time. They can only deduct the $1,500. If someone decided to hire the catering company for your organizations and paid the full $8,000 then they can deduct the $8,000 as an in-kind donation.

Recording and Valuing In-Kind Donations?

In-kind should be recorded at fair market value as contribution revenue as an asset or expense in the period received. Guaranteed Pledges to give noncash items are required to be recorded as contribution revenue in the period the promise is made even though the organization may not actually receive the asset or benefit until a future period. The pledged asset would be recorded when the contribution is made and expensed in the period of the benefit. The fair market value of in-kind tangible assets can be determined by using the price you would pay on an open market for the same or similar items. You can visit a local store or use the internet to make this task easier. Services received can be determined by the normal hourly rate charged for the provided service.

I decided as an accountant to donate thirteen hours of my consulting services, and my normal hourly rate is $200 per hour. Your organization would record $2,600 of contribution revenue and professional fees expense as a result.

Donors sometimes will provide discounted goods or services to your nonprofit organization. In these situations, your organization should record the difference between the market rate and the discounted rate paid as contribution revenue and expense like in the catering example above.

Recent Comments