by Donya Curry | Jan 12, 2021 | Bookkeeping, Business, Individuals, Non Profits

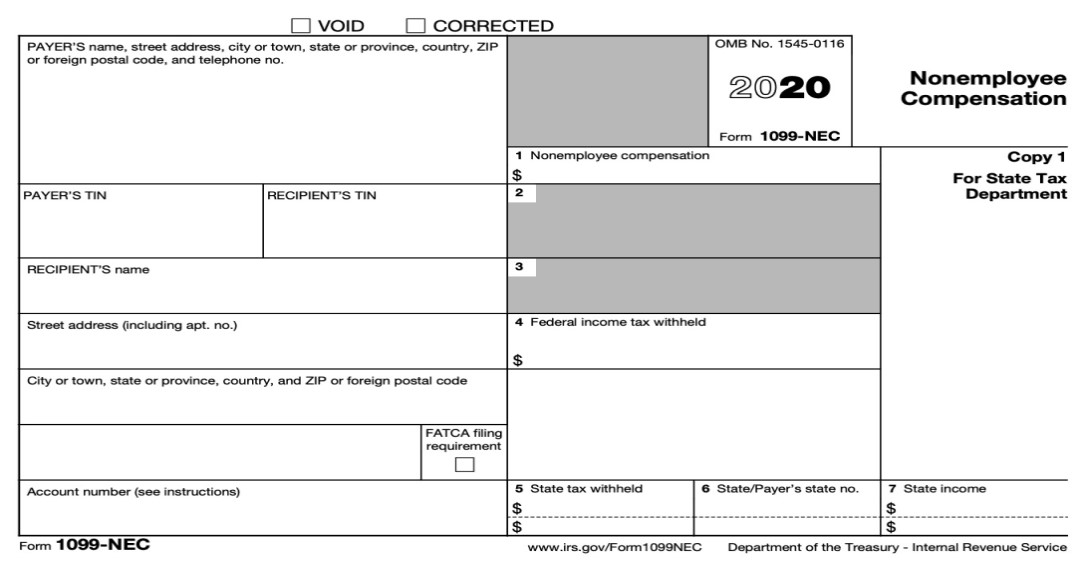

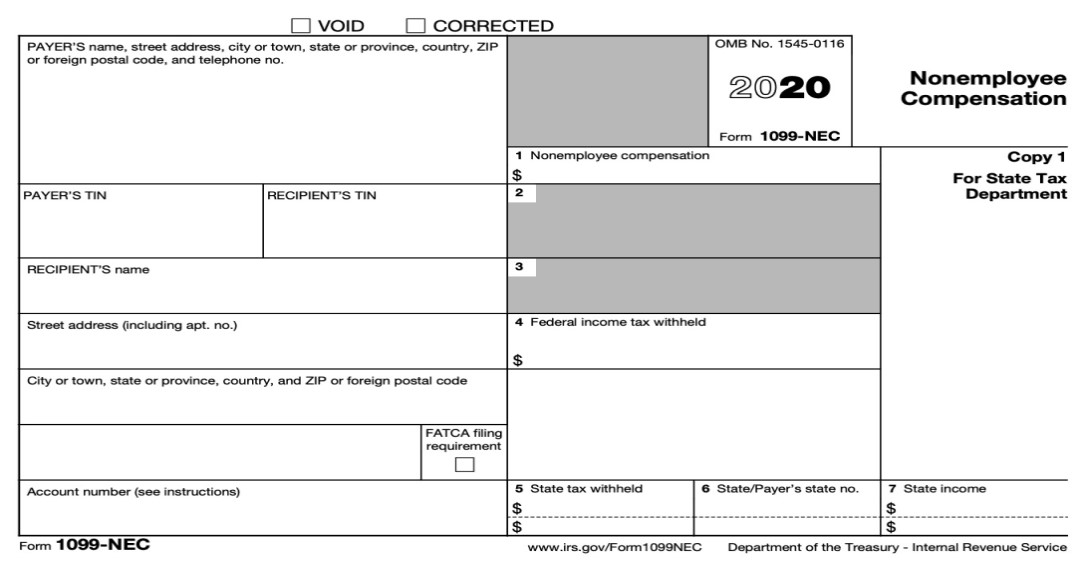

The IRS has introduced a new Form the 1099-NEC. The NEC is short for non employee compensation. This is the new form for reporting independent contractor income. The 1099-Misc will not be used to report income for individuals who’re self-employed in 2020.

What is a 1099-NEC?

The 1099-NEC is a new form created to report non-employee compensation.In previous years all independent contractors would receive a 1099-MISC form with the amount paid to you being reported in the box 7. The requirements to file a 1099-NEC are still the same as a 1099-Misc.

A 1099-NEC needs to be filed if your business paid any contractor more than $600 in a single tax year. You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment. Payments to a corporation including a limited liability company (LLC) that elected to be treated as a C or S corporation will not be required to file 1099-NEC. The exemption from reporting payments made to corporations does not apply to payments for legal services. Therefore, you must report attorneys’ fees (in box 1 of Form 1099-NEC). The entity type should be reported to you on a W-9 form.

Responsibilities for filing 1099-NEC?

It’s your company’s responsibility to file the Form 1099-NEC with the IRS and send a copy to the independent contractor by January 31. The due date is similar to the W-2’s. There are two copies that need to be filled out. Copy A is sent to the IRS while Copy B needs to be sent to the contractor. You can either e-file or send through mail.

If you missed the January 31st deadline, you will end up paying a penalty depending on how late the filing is. These penalties are:

$50 if you file within 30 days

$100 if you file more than 30 days late, but before August 1

$260 if you file on or after August 1

If you are unable to file on time, you can request an extension by submitting Form 8809 to the IRS. However, you will still need to supply the 1099-NEC forms to any contractors by January 31.If you need assistance completing your 1099 NEC. Please reach out to International Accounting & Tax Consultants (IATC Inc) at www.iatcpro.com.

by Donya Curry | Jan 11, 2021 | Bookkeeping, Business, Individuals, Non Profits

The President signed the “Consolidated Appropriations Act, 2021 into law. This law provided $284B dollars to be used for the second round of the Paycheck Protection Program. The application deadline for businesses wanting to receive a PPP2 loan is March 31, 2021. Due to the high demand expected, businesses should apply as early as possible. It is very likely the funds will be exhausted before the actual March deadline.

If your company received the first round of funding you are not automatically excluded from the second round of funding.

The new PPP2 loan requirements are a little different from the first round:

Your company must have less than 300 employees.

Must have been in operation before February 15, 2020.

Cannot be a publicly traded company.

Can’t be a business primarily engaged in political advocacy or lobbying.

Your company can not have significant ownership by Residents of China.

You must now be able to show at least a 25% reduction in gross revenue in any quarter of 2020 compared to the same quarter in 2019. If your business was new and didn’t exist the entire year of 2019. Use the quarters you were in business before February 2020.

Your business must have used the previous PPP loan or have a plan in place to use all of their original PPP loan for approved expenses.

PPP2 Forgiveness

The maximum amount of each loan is maxed at $2 million. Each entity can only have one PPP2 loan. The PPP2 loan forgiveness rules are similar to the PP1 rules. Payroll costs should account for at least 60% of the PPP2 loan amount spent and any remaining should be spent on other approved costs, all within the covered forgiveness period. The forgiveness period starts when you receive your PPP2 money in your bank account. Your company will either have an 8-week or a 24-week covered period of forgiveness. The approved Payroll costs includes an employee salary and benefits like vision and dental benefits. The “other” approved expenses would be the rent, mortgage interest, and utilities. Payments for software, cloud computing, HR systems, and accounting needs.

The PPP2 program included other additional expenses that are allowed to be covered. Any repair costs associated with looting or vandalism during 2020 disturbances when the cost of repairs were not covered by any insurance. Any payments made for essential goods for periods before the PPP2 loan was received. Payments for perishable items can also be made either before or after the PPP2 loan is received. Any PPE equipment or facility modification expenditures spent by your business to comply with COVID-19 federal health and safety guidelines. This would include items like face masks, drive-through windows, thermometers, and even HVAC improvements from March 1, 2020 throughout the year.

IATC Inc encourages businesses that qualify to apply as soon as possible for the PPP2 loan. If you need detailed information please feel free to contact us at www.iatcpro.com

by Donya Curry | Oct 24, 2019 | Business, Individuals

Every year after the extension due date new clients contact me ready to file their tax return. This is the time we find out extensions were not actually file, and now they have multiple penalties and interest to pay. I get them updated and write a letter to abate penalties.

The IRS isn’t in the business of letting people keep money. Penalty abatement is kind of easy the first time around for most clients. Some people don’t even feel it worth asking for penalty abatement/relief because everything involving the IRS is too complicated and time consuming. This is the part where I push up my glasses and tighten the tie getting ready to handle the hard part on their behalf.

I think taxpayers need to understand why the IRS actually uses penalties. Penalties are supposed to be a deterrent for people who fail to follow the rules and are out of compliance with the US tax code. They are a great way to bring in revenue for a under funded government branch so expect to see them applied whenever possible. The IRS apply millions of penalties to tax payers every year bringing in billions of easy money. Life happens and there are additional options to get penalties removed, or abated, for individuals ans businesses that qualify.

The most common used IRS penalties is the failure to file and failure to pay.

The IRS has over 130 different penalties the can assess. in the Internal Revenue Code, but two penalties make up 75% of all penalties assessed by the Internal Revenue Service.

Failure to pay penalty equals 60% of all penalties.

Failure to file penalty equals approximately 15% of all penalties.

The tax penalties can be disputed by providing an exception when filing your tax return.

Penalties will be removed by the Internal Revenue Service for a few reasons. We normally end up requesting penalty abatement for a statutory exception or reasonable cause.

Statutory exception- Are specific authoritative exclusions to the penalties. Statutory exceptions are rare, but rather easy to make a case for. A statutory exception would be a presidential declared disaster relief.

IRS Fault: If you can prove an error was the result of reliance on IRS advice. We always caution against following an agents advice. We default to the US Tax code and use that. To use the IRS error for a penalty relief is difficult and rarely successful. You need to have documented erroneous advice from the IRS that you reasonably relied on. The IRS doesn’t put tax advice in writing in majority of cases. You can also file penalty abatement based on erroneous verbal advice. Being able to successfully use either argument is not common.

Reasonable cause: providing a valid reason that you couldn’t comply based on your facts and circumstances. This argument normally includes chronic health problems and reliance on a bad tax professional or tax software. Those types of problems can be used under reasonable cause.

To successfully apply for an abatement using a reasonable cause argument for late filing and payment has its own requirements. You must demonstrate that you genuinely tried to comply. Your actions should demonstrate a sense of care. You need to show that your noncompliance was not due to your willful neglect.

IRS agents are also citizens and taxpayers just like you. To successfully prove a reasonable cause, you’ll need to make sure that the IRS knows all of the facts around the circumstances. It can seem unnecessary, but not all situations are the same. Leaving out facts that can clarify your position could result in you receiving a denial letter. If the denial letter fails to address facts crucial to your argument presented earlier. The option to request an appeal of the determination should be explored.

The IRS can provide administrative relief from a penalty under certain conditions. The most widely used relief is the first-time penalty abatement (FTA). FTA can be used to abate your failure to file, failure to pay, and other penalties for a single tax period. You do need to have a good history of filing your returns. You can use first time penalty abatement for your business tax penalties as well. FTA is the easiest of all penalty relief options to get approved. You just have to ask for it. If you need help with the IRS you should contact iIATC Inc for tax resolution services.

by Donya Curry | Feb 18, 2019 | Business, Individuals, Non Profits

Every year millions of tax returns are audited by the IRS. The average taxpayer main concern behind paying taxes is somehow causing the IRS to audit their tax returns. It’s true that certain things can automatically trigger an audit. An audit doesn’t actually mean your return is wrong. There are items on a return that present higher opportunities for committing fraud or mistakes.

The burden of proof for taking credits and deductions falls on your shoulders. You might have to prove that you are taking a position on your return in line with current tax code.

The audits are done primarily by mail today. There is a small chance of having an auditor show up in person. No matter how your audit is done you need to respond as soon as possible to ensure they don’t give you a default position. Letter normally state you have a certain amount of days from receiving the letter to respond if you disagree. If you don’t respond they automatically assume you agree with their findings in the letter. If you respond there are one of three things that happens.

The IRS auditors decides the information provided is correct and your return stays the same.

The IRS auditor proposes a change to your tax return, and you can agree to it and/or pay the appropriate taxes, interest or a penalty.

The IRS proposes a change you don’t agree. You have a chance to appeal and enter into an agreement with the IRS.

In the cases of serious tax fraud even though it’s an extremely rare outcome. The IRS can pursue forfeiture of property, jail time, and restitution.

Audit Flags

1. Reporting the wrong taxable income

The IRS actually receives your W-2,1099, and K-1’s before the taxpayers. This goes for both full-time employees and self-employed contractors.

You should check to see if your W-2 or 1099 you receive from any company matches your own records. If you think it is incorrect, immediately inform the company, and request that they file a corrected W-2 or 1099 with the IRS. If a company fails to update their information you would have to file a complaint with the IRS to go through this process of updating those records.

2. Charity donations

If you’re giving away large amounts of money to a charity when your income is low. Be prepared for some scrutiny from your tax pro and the IRS. If you are audited and can’t substantiate your donations. You and the tax pro will have fines and penalties to pay. Any large donation should be appraised, and you should file the Form 8283 for any donation over $500. Make sure you keep all of your charity receipts and follow the IRS’s tips for charitable donations.

3. Business Vehicles

Cars/ SUVs are still the main transportation for alot of business owners. Having a vehicles under your business doesn’t exclude you keeping track of personal miles. Running personal errands to pick up friends and go shopping should not be included. You should always keep a record of your mileage using qualified record keeping guidelines.

4. Home office

This deduction is on a lot of peoples deduction list. Who wouldn’t want to be able to take electricity, internet, and other expenses you use at home and get a benefit. There is a specific definition of what qualifies as a home office, so claiming it could easily trigger an audit. Ensure the room is where you do the majority of your work, and that is not used for any other purpose, especially personal use. This type of deduction can trigger an in-person audit where the IRS want to actually see the room you are claiming for a business deduction.

5. Tax Errors

Simple tax mistakes like small mathematical mistakes are the top reason for alot of audits. The IRS will normally fix these and send you a correction. This can also result in you actually receiving a larger refund as well.

6. Round numbers

On indication of making up income and expenses is have a series of even or round numbers. This is a common practice for people who don’t keep records and try to prepare a return from memory. Audits don’t always happen immediately. They normally come a few years later. You should have documentation to support your deductions and credits. When preparing you return use the actual numbers that match your receipts and other records.

7. Business Losses

The main requirement for being considered to have a business by the IRS is actually doing something to earn a profit. If your business just constantly loses money year after year it will cause some red flags. If you report a loss three out of the last five years. The IRS might consider your business a hobby or fraudulent depending on your specific circumstances. If you have a business ensure your run it like one with receipts and backup.

by Donya Curry | Jan 7, 2019 | Business

Uber and Lyft drivers are considered independent contractors. The beginning of the year you will receive a 1099 that details the images driven, fees taken, and income paid to you from each service. For those who made 20k and had over 200 rides or deliveries you will receive a 1099-k. As a Contractors you will file a schedule C with your 1040 individual returns.

Most rideshare drivers can deduct mileage, parking, tolls, food for passengers, and any other allowable expenses on Schedule C of their federal tax form.

The only requirement for claiming expenses is that they need to be “ordinary and necessary.”

Uber drivers are able to take deductions for:

- Car Payments. Yes, car payments are deductible. You don’t have to actually own your car. If you are making lease payments the amount you pay is deductible up to the portion of the business use of your vehicle.

- Licenses, Registration, Tags and Title, insurance, and uber fees are all deductible.

- Mileage Uber does tell you the mileage you drove for them, but you are required to keep track of your personal use of your vehicle before you can actually take the deduction.

- Tax and legal fees. You can deduct the cost of filing tax returns related to your business and tax planning. If you are a do it yourself type of person. you can take the cost of your tax prep software.

- Home Office Deduction

- The new 20% Deduction on Pass-Through Income. On top of the allowed business deductions, the current tax law allows you to take a 20% deduction on pass-through income. To qualify for this deduction, you need to have business income. As long as your income is $157,000 (filing single) and $315,000 (filing jointly). If you have a business loss you will not see this 20% deduction on pass through income. The deduction on pass-through income is set to expire on December 31, 2025.

This list is not an all inclusive list of the allowable deductions for rideshare drivers. These are some of the most common.

by Donya Curry | Dec 13, 2018 | Business

The new tax cuts and jobs act was recently signed into

law for 2018. There are some pros and cons from this passage. One of the

biggest changes is the overall decrease in corporate tax rates. Last year C

corporations were subject to graduated tax rates of 15% for taxable income up

to $50,000, 25% for income over $50,000 to $75,000, 34% for income over $75,000

to $10,000,000, and 35% for income over $10,000,000. If you happened to own a

personal service corporation, you were subject to a flat income tax rate of 35%

on all of your income. Now in the 2018 tax year the corporate tax rate a flat

21%. The new flat rate is now only 25% for personal service corporations. The

new tax cuts and jobs act (TCJA) also gets rid of the corporate alternative

minimum tax. An additional pro of the TCJA is the increased write off amounts

for §179 deductions when you purchase new vehicles and machinery. There is a

new pass through 20% deduction that your business could possibly take.

There were a few downsides for businesses in the TCJA.

The first con was the new 20% deduction phases out for higher income businesses

and personal service companies. The 2nd and major issue has been the

removal of the meals and entertainment deduction. Businesses that take clients

to sports events and restaurants will be losing this deduction. Food expenses

that were previously 100% write off in 2017 starting in 2018 they are now cut

to 50%. The food given out at your workplace like donuts and coffee will be a reduced

write off in 2018. No matter what changes go into law be prepared by planning

with a professional.

Recent Comments